Valued at $96.8 billion by market cap, Altria Group, Inc. (MO) is a leading tobacco company and consumer staples holding firm headquartered in Richmond, Virginia. It is one of the largest manufacturers and marketers of smokeable and oral tobacco products in the United States, with its most prominent brands including Marlboro cigarettes, Black & Mild cigars, and smokeless tobacco products such as Copenhagen and Skoal.

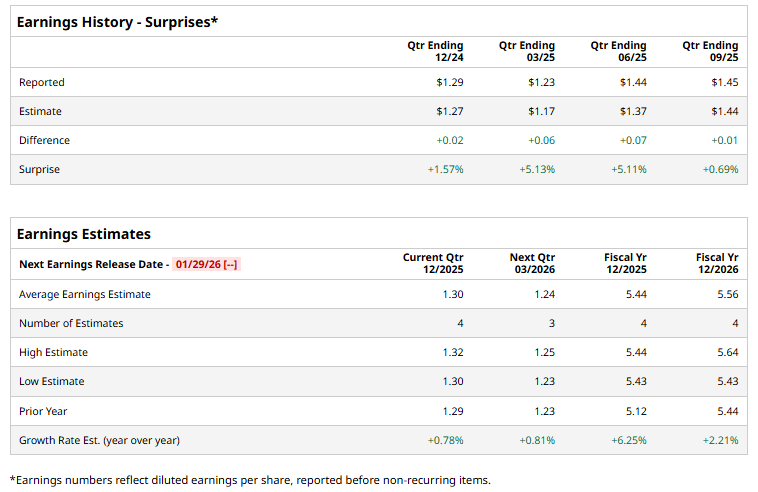

Altria Group is ready to release its fourth-quarter results soon. Ahead of the event, analysts expect MO to report an adjusted EPS of $1.30, up marginally from $1.29 reported in the year-ago quarter. The company has surpassed Street’s bottom-line estimates in all of the past four quarters.

For fiscal 2025, MO is expected to deliver an adjusted EPS of $5.44, up 6.3% from $5.12 reported in fiscal 2024. Its adjusted EPS is likely to rise 2.2% annually to $5.56 in FY2026.

Over the past 52 weeks, MO shares have climbed 10.8%, underperforming both the S&P 500 Index’s ($SPX) 16.4% return but outpacing the Consumer Staples Select Sector SPDR Fund’s (XLP) marginal fall during the same time frame.

On December 10, shares of Altria Group edged marginally higher after the company announced a regular quarterly dividend of $1.06 per share. The dividend is scheduled to be paid on January 9, 2026, to shareholders of record as of December 26, 2025, underscoring Altria’s continued commitment to returning capital to shareholders through its long-standing, income-focused dividend policy.

The consensus view on Altria is neutral with a “Hold” rating overall. Of the 14 analysts covering the MO stock, four recommend “Strong Buy,” eight advise “Hold,” one advocates “Moderate Sell,” and the remaining analyst gives a “Strong Sell” rating. Its mean price target of $61.45 implies an upswing potential of 6.6% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026