Shareholders of Super Micro would probably like to forget the past six months even happened. The stock dropped 23.6% and now trades at $31.26. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now an opportune time to buy SMCI? Find out in our full research report, it’s free for active Edge members.

Why Is Super Micro a Good Business?

Founded in Silicon Valley in 1993 and known for its modular "building block" approach to server design, Super Micro Computer (NASDAQ:SMCI) designs and manufactures high-performance, energy-efficient server and storage systems for data centers, cloud computing, AI, and edge computing applications.

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Super Micro grew its sales at an incredible 44.8% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $21.05 billion in revenue over the past 12 months, Super Micro is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

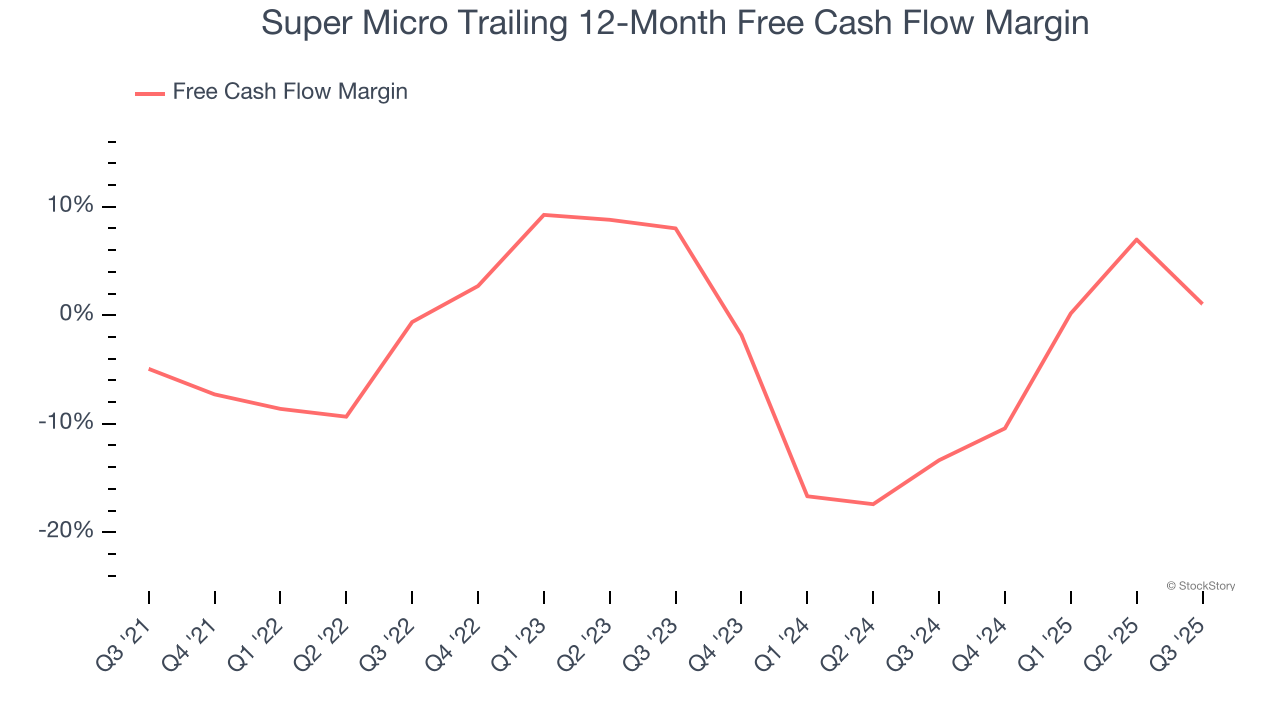

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Super Micro’s margin expanded by 6 percentage points over the last five years. Super Micro’s free cash flow margin for the trailing 12 months was 1%.

Final Judgment

These are just a few reasons why we think Super Micro is a high-quality business. After the recent drawdown, the stock trades at 12.6× forward P/E (or $31.26 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.