BellRing Brands currently trades at $75.92 and has been a dream stock for shareholders. It’s returned 338% since April 2020, blowing past the S&P 500’s 92.4% gain. The company has also beaten the index over the past six months as its stock price is up 16.6% thanks to its solid quarterly results.

Is now still a good time to buy BRBR? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On BRBR?

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

1. Elevated Demand Drives Higher Sales Volumes

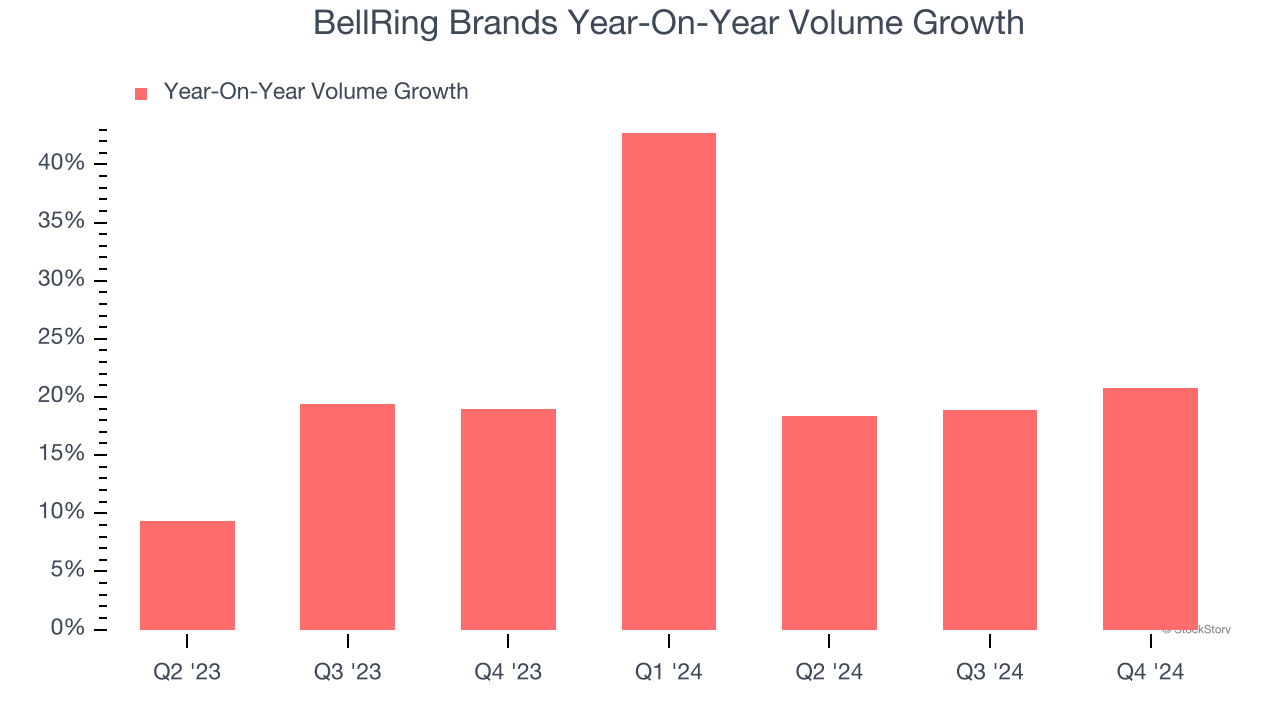

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

BellRing Brands’s average quarterly volume growth of 21.2% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

2. Outstanding Long-Term EPS Growth

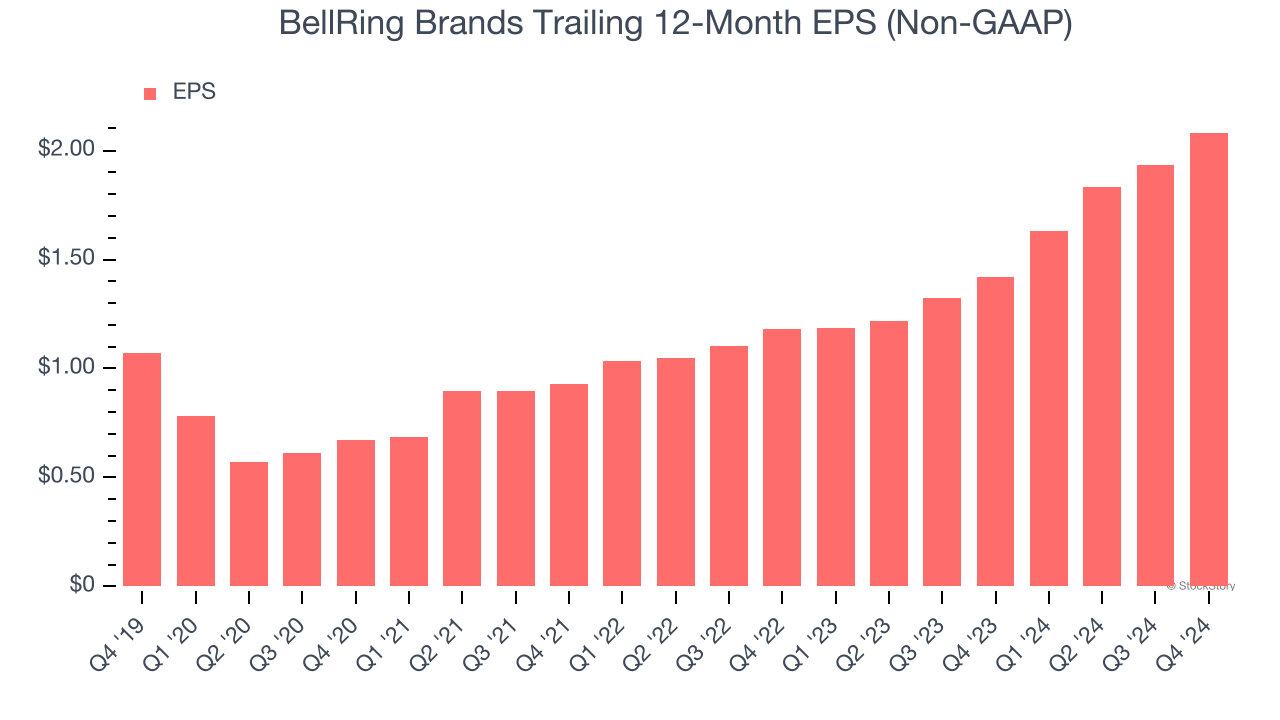

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

BellRing Brands’s EPS grew at an astounding 30.9% compounded annual growth rate over the last three years, higher than its 18.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

BellRing Brands’s five-year average ROIC was 47.7%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on BellRing Brands, and with its shares beating the market recently, the stock trades at 33.2× forward price-to-earnings (or $75.92 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than BellRing Brands

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.