Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

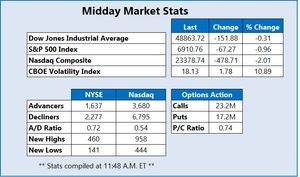

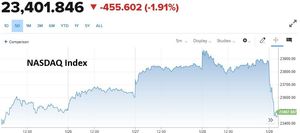

The S&P 500 settled lower on Thursday as Microsoft shares sold off amid slowing cloud growth and soft margin guidance, which triggered a triple-digit loss for the tech-heavy Nasdaq as software stocks struggled.

Via Talk Markets · January 29, 2026

Silver futures topped at $121.75 and then they plunged below $107, finally stabilizing close to $110. But the size of the intraday reversal serves as a reminder that the white metal can decline even faster than it climbs.

Via Talk Markets · January 29, 2026

Given the steep decline today, the software group is now trading at fresh local lows and has officially surpassed the 20% threshold from the October high to mark a new bear market.

Via Talk Markets · January 29, 2026

The recent price action in the precious metals, especially silver, has been nothing short of astounding.

Via Talk Markets · January 29, 2026

The markets just did something we haven't seen in decades.

Via Talk Markets · January 29, 2026

Current consensus EPS and revenue forecasts for Apple’s December-end quarter stand at $2.67 and $138.52B.

Via Talk Markets · January 29, 2026

Solana is under pressure as its price continues to decline.

Via Talk Markets · January 29, 2026

Weekly jobless claims fell to 209,000, extending a

Via Talk Markets · January 29, 2026

DXY falls every time EEM and EFA rise which indicate capital flows are exiting the U.S. Dollar for foreign markets.

Via Talk Markets · January 29, 2026

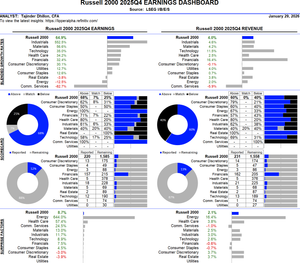

The 25Q4 Y/Y blended earnings growth estimate is 64.9%. If the energy sector is excluded, the growth rate for the index is 72.0%.

Via Talk Markets · January 29, 2026

Southwest’s transition reflects a broader recalibration of its business model, as the airline seeks to move beyond its traditional no-frills approach.

Via Talk Markets · January 29, 2026

MSTR stock hits a 52-week low as Bitcoin drops below $84K, dragging down Strategy’s value amid broader market sell-off.

Via Talk Markets · January 29, 2026

Corn was higher on U.S. Dollar weakness. Trends are up due to the recent demand based rally and after production was increased in the annual report.

Via Talk Markets · January 29, 2026

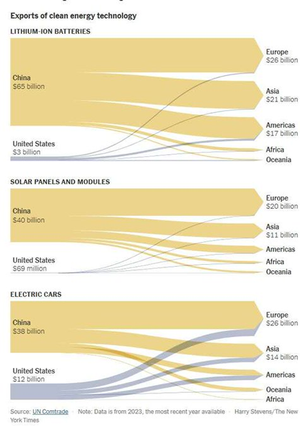

China has spent the past two decades building manufacturing capacity, subsidizing scale, automating factories, securing raw materials and investing heavily in research.

Via Talk Markets · January 29, 2026

Wall Street's slumped due to a sell-off in the tech sector, partially explaining the recent market movements, but not completely.

Via Talk Markets · January 29, 2026

Markets dipped before Powell, then reversed higher on a stop-hunt bounce, with earnings and shifting dollar/gold moves setting up more volatility ahead.

Via Talk Markets · January 29, 2026

A 2026 post-earnings review on Tesla and its news from yesterday to pre-market open today.

Via Talk Markets · January 29, 2026

IBM recently announced the $11 billion acquisition of Confluent as it positions itself to cater to the evolving AI driven IT landscape.

Via Talk Markets · January 29, 2026

Usually placid and steadily rising, gold is now skyrocketing like bitcoin in the midst of a bull run, while the digital currency is enjoying a year of calm and stability.

Via Talk Markets · January 29, 2026

The precious metals – especially silver – have gotten overly extended to the upside while the dollar seems due for a countertrend rally.

Via Talk Markets · January 29, 2026

Mastercard remains in focus on Thursday after reporting a market-beating Q4.

Via Talk Markets · January 29, 2026

US equities faced renewed pressure on Thursday as megacap technology earnings and the Fed’s tepid showing this week weighed on sentiment.

Via Talk Markets · January 29, 2026

As silver prices continue to set new highs, pundits speculate about supply issues, market manipulation, and inflation fears.

Via Talk Markets · January 29, 2026

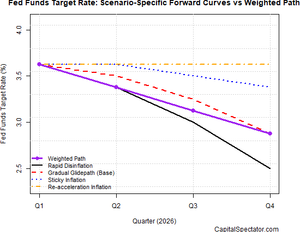

At its January 2026 meeting, the US Federal Reserve left the federal funds rate unchanged in the 3.50-3.75% range, fully meeting market expectations.

Via Talk Markets · January 29, 2026

Via Talk Markets · January 29, 2026

Nvidia stock fell sharply on Thursday, dropping around 2% as a broad pullback in risk assets swept through global markets, dragging down technology stocks and triggering violent reversals across asset classes.

Via Talk Markets · January 29, 2026

Novo Nordisk shares in Europe appear to be forming a base after a 5.5-month bottoming process, following a mid-2024 peak and a subsequent 71% collapse.

Via Talk Markets · January 29, 2026

Nvidia is showing signs of a false breakout on its technical chart. After a period of consolidation, the stock attempted to move higher but has since retreated, signaling a potential pullback and the need for traders to manage risk.

Via Talk Markets · January 29, 2026

Ethereum's exchange supply drops as staking increases, with more ETH locked and steady price movement driving the trend.

Via Talk Markets · January 29, 2026

We discuss why investors, institutions and governments continue buying precious metals at prices that would normally deter demand

Via Talk Markets · January 29, 2026

The FTSE100 inched higher in its ascending channel as prices close in on a record peak.

Via Talk Markets · January 29, 2026

The Dow Jones Industrial Average, Nasdaq Composite, and S&P 500 Index are plunging into the red, as a post-earning Big Tech selloff gets underway.

Via Talk Markets · January 29, 2026

ASML’s EUV monopoly makes it the ultimate beneficiary of AI-driven compute scarcity, but investors still have to face entry-price discipline.

Via Talk Markets · January 29, 2026

Bitcoin is at a massive crossroads, and the charts are telling a different story than the headlines.

Via Talk Markets · January 29, 2026

Oil and diesel cracks have pulled back a little bit with the strength in the oil.

Via Talk Markets · January 29, 2026

After the FNGD incident yesterday, I’ve decided to go full-on loopy and defy precious metals. Here is what /GC has been up to. I draw your attention to that shooting star.

Via Talk Markets · January 29, 2026

Volume Price Analysis helps traders cut through news noise, use volatility to spot buying/selling climaxes and institutional activity, and stay confident across timeframes by reading supply and demand through volume.

Via Talk Markets · January 29, 2026

London’s benchmark index gained momentum on Thursday, buoyed by robust performances in financial and commodity stocks, as investors analysed a slew of corporate earnings reports.

Via Talk Markets · January 29, 2026

The broad equity indexes, especially the tech-heavy Nasdaq, are falling hard this morning.

Via Talk Markets · January 29, 2026

Chrome will now browse the web for you. Auto Browse, powered by Gemini 3, is an agentic feature that navigates websites, fills out forms, compares options, and completes multi-step tasks on your behalf.

Via Talk Markets · January 29, 2026

A confident Chair Powell declared a hold for rates, and sounded a glass-half-full narrative for the US economy; we sniff some rates upside ahead.

Via Talk Markets · January 29, 2026

Boeing closed out 2025 on a strong footing, delivering a lights-out quarter.

Via Talk Markets · January 29, 2026

With demand for gold and silver at a fevered pitch, speculative mania has driven premiums in China to extremely high levels, creating tension in the marketplace.

Via Talk Markets · January 29, 2026

Southwest Airlines shares jumped more than 12% after the company reported Q4 results and projected 2026 adjusted EPS of at least $4.00.

Via Talk Markets · January 29, 2026

Verizon has declared and paid variable quarterly dividends since January 2001. The February 2026 Quarterly dividend of $0.69 suggests a $2.76 annual dividend for the coming year.

Via Talk Markets · January 29, 2026

Although the benchmark indices opened lower, they traded volatily throughout the session and ultimately closed green.

Via Talk Markets · January 29, 2026

The technical picture on the Nasdaq 100 futures looks positive, given that it has just broken out of a multi-week consolidation to the upside this week, moving above former resistance in the 25,880 to 26,045 region.

Via Talk Markets · January 29, 2026

The EUR/USD is near the 1.19500 level, with fast conditions still shaking the broad Forex market.

Via Talk Markets · January 29, 2026

As usual, the Federal Reserve did exactly what everybody expected at its January meeting.

Via Talk Markets · January 29, 2026

We don't expect any changes from the European Central Bank at next week's meeting.

Via Talk Markets · January 29, 2026

The Federal Reserve left interest rates unchanged yesterday, as expected, but the challenges are increasing for identifying the right monetary policy for the path ahead.

Via Talk Markets · January 29, 2026

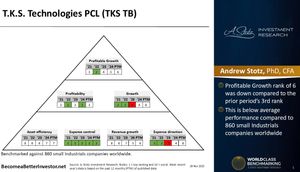

T.K.S. Technologies Public Company Limited is a holding company investing in digital technology and security solutions in Thailand.

Via Talk Markets · January 29, 2026

Comcast’s latest earnings underline how the company’s business mix is changing as pressure builds on its traditional cable operations.

Via Talk Markets · January 29, 2026

The number of Americans filing for jobless benefits for the first time declined from 210k (upwardly revised from 200k) to 209k (slightly above the 205k exp), but remained near those multi-decade lows and showed no signs of labor market stress.

Via Talk Markets · January 29, 2026

The European Commission's economic sentiment indicator increased in January, which bodes well for first-quarter growth.

Via Talk Markets · January 29, 2026

That’s what Powell keeps saying.

Via Talk Markets · January 29, 2026

GBP/USD remains near its August 2021 highs, holding around 1.3834 on Thursday, as heightened volatility in the US dollar continues to weigh on the pair.

Via Talk Markets · January 29, 2026

The market extended the greenback’s recovery when Treasury Secretary Bessent told the CNBC audience that the US always supports a strong dollar.

Via Talk Markets · January 29, 2026

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This is a reality check for the industry.

Via Talk Markets · January 29, 2026

The Dow managed to restore strength after U.S. President Donald Trump abandoned his tariff threat against Europe, easing trade-war concerns.

Via Talk Markets · January 29, 2026

The GBP/USD forecast remains tilted to the upside, aiming for 1.3925 as the dollar loses further after the FOMC meeting.

Via Talk Markets · January 29, 2026

After cutting 14,000 jobs back in October and denying there were more of them coming, Amazon confirmed there will be another 16,000 layoffs and made comments suggesting the company won’t be done even after then.

Via Talk Markets · January 29, 2026

USD/JPY steadies post-Fed, intervention risks remain. FTSE rises as oil majors and miners rally.

Via Talk Markets · January 29, 2026

Caterpillar reported record Q4 revenue of $19.1 billion and adjusted earnings of $5.16 per share, beating market expectations.

Via Talk Markets · January 29, 2026

The commodities market continues to sizzle, with gold, silver, and copper hitting new highs as the weakening US dollar and rising geopolitical tensions drive investors toward tangible assets for protection.

Via Talk Markets · January 29, 2026

EUR/USD treads water near 1.2000 after bouncing up from the 1.1900 area.

Via Talk Markets · January 29, 2026

The S&P 500 has spent the bulk of January, perhaps doing so in order to work off some of the excess that the markets have seen for the last several months.

Via Talk Markets · January 29, 2026

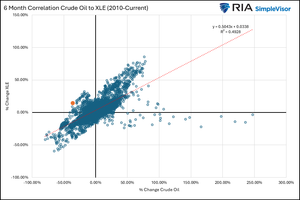

Crude oil price edged higher on Wednesday as weather disruptions and a weaker US dollar bolster the asset.

Via Talk Markets · January 29, 2026

Over the last year, energy stocks have traded well despite crude oil prices languishing.

Via Talk Markets · January 29, 2026

Global markets kick off the day with a high risk and reflation tone following the Fed’s decision to hold rates steady, which reinforced expectations for a near-term pause and helped pressure the dollar.

Via Talk Markets · January 29, 2026

Indian share markets are trading lower, with the Sensex trading 439 points lower, and the Nifty is trading 115 points lower.

Via Talk Markets · January 29, 2026

The dollar has shown signs of stabilising, but has struggled to stay bid on Bessent’s ruling out JPY intervention and a slightly hawkish Fed.

Via Talk Markets · January 29, 2026

Despite volatility from Microsoft and Meta earnings, the index is navigating a sub-minuette wave 4 correction, with gold and silver continuing their vertical, record-breaking rallies.

Via Talk Markets · January 29, 2026

AI infrastructure stocks like Arista and CoreWeave are surging. Backed by a $2.1B Nvidia investment, CoreWeave has spiked 40% this month, while Arista rides the 800G networking wave for hyperscalers like Meta.

Via Talk Markets · January 29, 2026

The Indian Rupee gains ground amid speculation of the RBI intervention, aiming to curb losses as the pair touched a fresh all-time high of 92.19 on January 28.

Via Talk Markets · January 29, 2026