Advanced Micro Devices, Inc. - Common Stock (AMD)

240.71

-11.47 (-4.55%)

NASDAQ · Last Trade: Jan 30th, 11:38 AM EST

Detailed Quote

| Previous Close | 252.18 |

|---|---|

| Open | 236.93 |

| Bid | 240.71 |

| Ask | 240.81 |

| Day's Range | 235.75 - 245.24 |

| 52 Week Range | 76.48 - 267.08 |

| Volume | 16,764,948 |

| Market Cap | 291.97B |

| PE Ratio (TTM) | 119.16 |

| EPS (TTM) | 2.0 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 35,802,678 |

Chart

About Advanced Micro Devices, Inc. - Common Stock (AMD)

Advanced Micro Devices is a leading global semiconductor company that designs and manufactures computing and graphics solutions for a wide range of applications. The company is known for its innovative microprocessors, graphics cards, and system-on-chip products, which are used in personal computers, servers, and embedded systems. AMD focuses on high-performance computing, gaming, and data center markets, offering advanced technologies that compete with those of other major players in the industry. By delivering cutting-edge products that push the boundaries of processing power and efficiency, AMD plays a critical role in driving technological advancements and enhancing user experiences across various platforms. Read More

News & Press Releases

In a landmark announcement this January 2026, the RIKEN Center for Computational Science (R-CCS) has officially selected NVIDIA (NASDAQ:NVDA) Grace Blackwell architectures to power the developmental stages of "FugakuNEXT," the highly anticipated successor to the world-renowned Fugaku supercomputer. This strategic move signals a paradigm shift in Japan’s high-performance computing (HPC) strategy, moving away from a [...]

Via TokenRing AI · January 30, 2026

The semiconductor industry has officially reached a historic inflection point. As of late January 2026, the transition from traditional electrical signaling to light-based data movement has moved from the laboratory to the fabrication line. This week, the industry-shaking partnership between silicon photonics pioneer Lightmatter and Global Unichip Corp (TWSE:3443), commonly known as GUC, has entered [...]

Via TokenRing AI · January 30, 2026

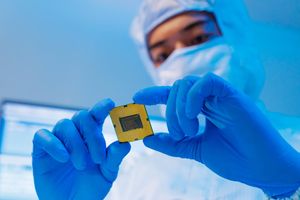

As of January 30, 2026, the global semiconductor landscape is undergoing a tectonic shift. Samsung Electronics (KRX: 005930) has officially reached a critical performance and yield milestone for its 2nm (SF2P) production process, signaling a major challenge to the long-standing dominance of Taiwan Semiconductor Manufacturing Company (NYSE: TSM). Following its Q4 2025 earnings report, Samsung [...]

Via TokenRing AI · January 30, 2026

In a landmark move that signals a tectonic shift in the global semiconductor landscape, Microsoft Corp. (NASDAQ:MSFT) has officially become the flagship foundry customer for Intel Corporation’s (NASDAQ:INTC) most advanced process node to date: the Intel 18A-P. Announced in late January 2026, the partnership centers on the domestic production of Microsoft’s custom-designed "Maia 2" AI [...]

Via TokenRing AI · January 30, 2026

The landscape of personal computing underwent a seismic shift at CES 2026 as Intel (NASDAQ: INTC) officially unveiled its Core Ultra Series 3 processors, codenamed "Panther Lake." Representing the most significant architectural leap for the company in a decade, Panther Lake is the first consumer lineup built on the highly anticipated Intel 18A process node. [...]

Via TokenRing AI · January 30, 2026

The cloud computing landscape shifted significantly this month as Amazon.com, Inc. (NASDAQ: AMZN) officially launched its highly anticipated Amazon EC2 G7e instances. Marking the first time the groundbreaking NVIDIA Blackwell architecture has been made available in the public cloud, the G7e instances represent a massive leap forward for generative AI production. By integrating the NVIDIA [...]

Via TokenRing AI · January 30, 2026

In a decisive move that reshapes the competitive landscape of artificial intelligence infrastructure, Samsung Electronics (KRX: 005930) has officially cleared the final quality and reliability tests for its 6th-generation High Bandwidth Memory (HBM4) from both NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD). As of late January 2026, this breakthrough signals a major reversal of fortune [...]

Via TokenRing AI · January 30, 2026

In a move that has sent shockwaves through the global semiconductor industry, NVIDIA (NASDAQ:NVDA) has officially finalized its $5 billion strategic investment in long-time rival Intel (NASDAQ:INTC) as of January 2026. This historic partnership, which grants NVIDIA an approximate 4% stake in the legendary chipmaker, marks the end of a multi-year transition for Intel and [...]

Via TokenRing AI · January 30, 2026

At the prestigious NEPCON Japan 2026 exhibition in Tokyo, Intel (NASDAQ: INTC) has fundamentally altered the roadmap for high-performance computing by unveiling its first "thick-core" glass substrate technology. The demonstration of a 10-2-10-thick glass core substrate marks a historic transition away from traditional organic materials, promising to unlock the next level of scalability for massive [...]

Via TokenRing AI · January 30, 2026

On January 15, 2026, the global technology landscape underwent a seismic shift as the United States and Taiwan formally signed the "2026 US-Taiwan Trade and Investment Agreement." Valued at a staggering $250 billion in direct investment commitments—supplemented by an additional $250 billion in credit guarantees—the accord, colloquially known as the "Silicon Pact," represents the most [...]

Via TokenRing AI · January 30, 2026

AMD stock has a particular character that investors should consider carefully despite the positive market sentiment.

Via Investor's Business Daily · January 30, 2026

The chipmaker wants to pull ahead of TSMC with a big bet on ASML's cutting-edge systems.

Via The Motley Fool · January 30, 2026

Most Wall Street analysts advise buying this stock.

Via The Motley Fool · January 30, 2026

Semiconductors have been one of the market's best-performing sectors. Thanks to these catalysts, the good times may not be over yet.

Via The Motley Fool · January 30, 2026

A rare moment of shortsightedness on the Oracle of Omaha's part cost Berkshire Hathaway a small fortune.

Via The Motley Fool · January 30, 2026

The stock looks expensive, but AMD could see robust demand for its data center chips in the coming years.

Via The Motley Fool · January 30, 2026

Hyperscalers are expected to spend $500 billion on AI- related capital expenditures in 2026.

Via The Motley Fool · January 30, 2026

Intel still needs time to capitalize on the AI chip market's growth, but its rival is already making solid progress in this space.

Via The Motley Fool · January 29, 2026

Taiwan Semiconductor is the reason why AI technology is real.

Via The Motley Fool · January 29, 2026

Taiwan Semiconductor recently put up stellar fourth-quarter numbers, signaling that we've yet to reach peak AI demand. Are we in for another banner year in 2026?

Via The Motley Fool · January 29, 2026

Nvidia will have a great 2026, but you can't go all-in on the stock.

Via The Motley Fool · January 29, 2026

The Dutch semiconductor equipment maker has a bright future.

Via The Motley Fool · January 29, 2026

AMD’s EPYC processors are gaining traction in data centers, while its Instinct GPUs are benefiting from the accelerating AI demand.

Via Barchart.com · January 29, 2026

Intel’s post-earnings selloff highlights supply challenges that could shift market share in the server CPU market toward AMD, creating a buying opportunity in the stock.

Via Barchart.com · January 29, 2026

Nvidia’s 2028 foundry interest boosts Intel’s long-term case, but near-term execution risks and supply limits still cloud the stock’s path.

Via Barchart.com · January 29, 2026